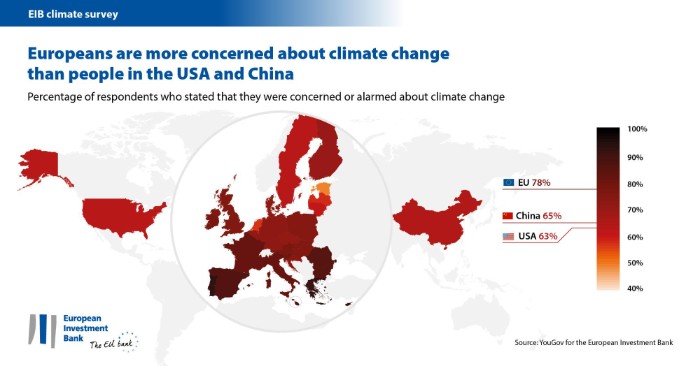

A study conducted by McKinsey and NielsenIQ analyzes the sales growth of environmentally and socially responsible products. While the study’s focus is on the United States, European companies can still benefit from the research’s key findings, especially considering that Europeans are more concerned about climate change than people in the USA and China according to the EIB Climate Survey.

Additionally, it’s important to remember that climate change is a global issue that necessitates contributions and resolutions from around the world. This is also emphasized in the book “There is No Planet B” by Mike Berners-Lee. With that in mind, let’s examine the McKinsey study more closely.

Every year, US consumers spend more than $14 trillion which makes up two-thirds of the country’s GDP. A significant portion of this spending is on everyday consumer packaged goods (CPG) like food, drinks, cosmetics, and cleaning products. The CPG sector is massive, employing millions and generating trillions in sales, making it crucial in creating a more sustainable and equitable economy.

Consumer packaged goods (CPG) companies are focusing more on being environmentally and socially responsible and are adding labels on their products to reflect that. You can see these labels, like “environmentally sustainable,” “eco-friendly,” or “fair trade,” in grocery and drugstore aisles. It’s crucial to evaluate the real impact business practices have on achieving goals like reducing carbon emissions, offering fair wages and working conditions, and promoting diversity and inclusion, rather than just relying on product claims. Additionally, it’s important to understand how customers react to social and environmental claims, which hasn’t been clear previously.

According to a 2020 McKinsey US consumer sentiment survey, over 60 percent of respondents expressed a willingness to pay more for a product that comes with environmentally and ethically sustainable packaging when asked if it matters to them while making their purchasing decisions.

According to NielsenIQ, 78 percent of US consumers prioritize leading a sustainable lifestyle. However, CPG executives face a challenge with their company’s ESG initiatives as they struggle to generate enough consumer demand for those products. Despite introducing new products with ESG-related claims, some companies have experienced lower sales than anticipated.

Is it accurate to say that consumers care about products that incorporate ESG-related claims and that they follow through with their buying decisions while standing in front of store shelves or browsing online? Or do their actual purchasing behaviors differ from their stated preferences? The manufacturing and certification costs of products that fulfill ESG-related claims may be significant, especially in an inflationary environment. Companies must evaluate the demand for products with ESG-related claims when deciding where to invest in their business. To make informed decisions, they should prioritize understanding how these claims can impact consumer purchasing behavior. In other words, companies should determine if consumers are more likely to buy a product that has an ESG-related claim on its package. Can the value of a claim vary based on certain factors like product price or brand status? Are some types of claims more effective than others? To explore these questions and more, McKinsey and NielsenIQ conducted a thorough study analyzing the spending patterns of US consumers rather than just relying on their reported intentions. This makes the study different than previously performed studies (Deloitte the Sustainable Consumer). For CPG companies, producing environmentally and socially responsible products is not only a moral obligation, but also a beneficial business decision. This supports their ESG strategies and commitments based on factual observations.

Over the last five years, products that made claims related to ESG (Environmental, Social, and Governance) achieved a 28% cumulative growth rate, which is higher than the 20% growth rate attained by products that didn’t make any ESG-related claims.

It is important to note that this study only provides initial insights into how consumers perceive and value brands with ESG-related claims. There are limitations to this study, as it only looks at the sales growth of products with ESG-related claims compared to similar products without these claims. It does not definitively prove whether consumers purchased these brands specifically because of the ESG claims or for other reasons. The study does not take into account variables like marketing investments, distribution, and promotional activity, but rather focuses on examining the connection between ESG-related claims and sales performance.

It should be noted that McKinsey and NielsenIQ did not verify the accuracy of ESG-related claims made by these products. Companies need to support their ESG claims with genuine efforts in order to promote a sustainable and inclusive economy. Misleading claims about a product’s environmental or social benefits, also known as “greenwashing,” can harm a business’s reputation by eroding consumer trust. The only examines the relationship between ESG-related claims and consumer purchasing can impact people’s ability to make environmentally and socially responsible choices and may weaken regulators’ influence.

Our strategy: Focusing on specific ESG factors in the products displayed in our store aisles.

McKinsey analyzed five years of US sales data from 2017 to June 2022 in partnership with NielsenIQ. The data included 600,000 individual product SKUs, representing $400 billion in annual retail revenues. The 44,000 brands included 32 categories of food, beverage, personal-care, and household products.

Thanks to NielsenIQ’s measurement capabilities, we were able to identify 93 ESG-related claims displayed on the products’ packages. These claims included terms like “cage-free,” “vegan,” “eco-friendly,” and “biodegradable,” which were categorized into six classifications: animal welfare, environmental sustainability, organic-farming methods, plant-based ingredients, social responsibility, and sustainable packaging (refer to the sidebar, “Six types of ESG claims” for more information). The research used consumer insights from NielsenIQ’s household panel, which monitors the buying habits of over 100,000 households in the United States. The study analyzed sales growth rates of products in different categories from 2017 to 2022. The research compared the growth rates of products with and without ESG-related claims, taking into account other factors such as brand size, price tier, and whether the product was new or established. The results offer information on whether products that make ESG-related claims outperform their counterparts in terms of growth, as well as the extent of this outperformance. Additionally, the results compare the performance of different types of products and claims to each other.

Although not every brand saw a positive effect on sales despite making ESG-related claims, the data indicates that there is a significant link between these claims and consumer spending across many product categories. This study highlights four important insights for consumer companies and retailers who prioritize environmentally and socially responsible products as part of their overall ESG strategies and impact commitments.

1. Customers are increasingly purchasing items that feature claims related to environmental, social, and governance (ESG) factors.

The study’s primary objective was to investigate whether products with ESG-related claims on the packaging performed better than those without such claims over a five-year period. By comparing each product’s initial sales share with its five-year growth rate, the researchers discovered that customers are aligning their buying habits with their ESG preferences. Overall, the study demonstrated a significant connection between ESG-related claims and consumer spending in multiple categories.

Over the last five years, products that claim they are environmentally friendly, socially responsible, and well-governed constituted 56 percent of all growth. This is 18 percent more than anticipated from their starting point. Products that make these claims had an average cumulative growth of 28 percent over the five-year term, compared to 20 percent for products that did not make such claims. In terms of CAGR, products that made ESG-related claims had a 1.7 percentage-point edge over products that didn’t have such claims. This is a significant amount considering the industry’s maturity and modest growth. As a result, products with ESG-related claims make up almost half of all retail sales in the analyzed categories.

Exhibit 2 shows that growth varied across different categories. ESG-related products saw significant growth in 11 out of 15 food categories and three out of four personal-care categories, but only in two out of nine beverage categories. However, it is not possible to determine the reasons behind these differences through shopping data alone. For instance, in the children’s formula and nutritional-beverage category, consumers may rely on advice from doctors and prioritize clinical recommendations over ESG-related claims.

Although there were some exceptions, the general pattern was evident: products that made ESG-related claims had a higher growth rate than those that didn’t in about two-thirds of categories. NielsenIQ’s panel data demonstrated that certain demographic groups, such as higher-income households, urban and suburban dwellers, and households with kids had a greater propensity to purchase products that made ESG-related claims. According to research, consumers with varying incomes, ages, races, and geographical locations are purchasing products with ESG-related labels. The average deviation across these demographic groups for environmentally and socially conscious buyers compared to the general population is around 15%. This indicates that the demand for environmentally and socially responsible products is not limited to a specific audience and is gaining popularity among a larger group of consumers in America.

2 Brands of various sizes that made claims related to Environmental, Social and Governance (ESG) achieved varying levels of growth.

Both large and small brands experienced growth in products with ESG-related claims. The study found that in 59% of all categories, smaller brands that made such claims achieved more significant growth, while in 50% of categories, the largest brands that made these claims also saw disproportionate growth (see Exhibit 3). For example, smaller brands experienced rapid growth in sports drinks and hair care, while larger brands saw more growth in fruit juice and sweet snacks.

Medium-size brands’ underperformance may be due to their smaller marketing and distribution scale compared to large brands. Additionally, they may not benefit from the same aura of credibility that smaller brands enjoy. However, the data does not provide a clear explanation for this phenomenon.

The data shows that in 32 percent of categories, newer products that made claims about being better did not actually outperform their non-claiming counterparts. However, in 68 percent of categories, established products that made ESG-related claims did outperform established products without such claims. It is unclear why these differences exist.It is hypothesized that shoppers might anticipate newer products to have ESG-friendly claims, but they are pleasantly surprised when older ones make such claims instead. It’s worth noting that established products which made ESG-related claims witnessed slower sales declines compared to those that did not.

Products claiming ESG-related benefits showed consistent performance across all price ranges. This could be due to the fact that private-label products, which often make such claims, dominate the lower price tiers. Private-label products claiming ESG benefits outperformed expectations and captured more than their fair share of growth in 88 percent of categories.

This discovery indicates that customers who opt for store brands may not just be looking for the least expensive options, but may also be interested in backing economical environmentally and socially conscious products. With rising prices, affordability is likely to become more significant for shoppers. Hence, manufacturers and sellers in the consumer packaged goods industry may perceive this information as encouragement to provide more ESG-conscious options to their budget-focused customers at lower costs.

3. There was no ESG-related product claim that performed better than all others, but it was found that less common claims were usually associated with greater effects.

There is no evidence that a specific claim is consistently associated with significant growth across all categories. However, we discovered that rarer claims result in higher growth than more common ones. This suggests that claims can differentiate a product, especially if they align with a company’s ESG goals and commitments.

According to data, products with the least common claims like “vegan” or “carbon zero” grew by 8.5% more than products without such claims. Products with medium-common claims such as “sustainable packaging” or “plant-based” had a 4.7% growth differential over their peers. Surprisingly, products with the most common claims like “environmentally sustainable” had the smallest growth difference. However, even with such widespread claims, these products still experienced roughly 2% higher growth than products without these claims. This indicates that even common claims can have a positive impact on growth.

NielsenIQ’s household panel data analysis shows that there is a connection between a brand’s ESG-related claims and the loyalty of its consumers. This is shown in Exhibit 4.

If a brand earns more than 50% of their sales from products with ESG-related claims, their repeat rates are between 32% to 34%. Repeat rates refer to the number of times a buyer purchases products from that brand per year. On the other hand, brands that earn less than 50% of their sales from ESG-related claims have repeat rates of less than 30%. Although this difference doesn’t serve as definitive proof that consumers favor brands solely due to their ESG-related claims, it does imply that taking a more comprehensive approach towards ESG issues throughout a brand’s portfolio has the potential to boost overall brand loyalty amongst consumers.

4. If you merge multiple statements, it can enhance the credibility of the message.

The study examined how displaying various types of ESG-related claims on a product package affects its growth. Results showed that products with multiple claims across the six ESG themes grew faster than those without. In almost 80% of the categories, there was a direct correlation between the product’s growth rate and the number of distinct ESG-related claims it made. Products with multiple claims grew twice as fast as those with only one claim. (See Exhibit 5.)

We want to make it clear that adding more claims and certifications to their products alone will not earn companies recognition. Such claims must be supported by actual actions that have a real environmental, social, and governance impact. We highlighted the dangers of greenwashing in our introduction, and companies should take it seriously. Nevertheless, our research indicates that consumers may perceive a brand’s multiple claims as more authentic with regards to ESG-related behavior, compared to a brand with only one claim. The message suggests that brands should evaluate their dedication to ESG practices and consider the various social and environmental factors that are integral to their products.

How will consumer companies and retailers be impacted by this?

In the last hundred years, the global economy has relied heavily on consumer consumption to achieve prosperity and growth. This approach has resulted in significant social and environmental consequences due to the production, transportation, and disposal of consumer goods. Therefore, both consumers and companies have a moral responsibility to consider and address these impacts on society and the planet when making purchasing decisions and taking ESG-related actions. Product label claims—if they represent true and meaningful environmental and social action—can be an important part of fulfilling this moral imperative.

Companies that manufacture and sell consumer packaged goods have various opportunities to invest in environmentally and socially responsible features and claims. To prioritize and make the most out of their ESG commitments, it is crucial for companies and retailers to identify and invest in ESG-related actions that deliver the highest advancement. They should also inform customers about those actions, which can be done through product label claims. Consider these insights from our research when trying to achieve differentiated growth while advancing ESG commitments.

Takeaways

- To make meaningful environmental and social impact across their portfolio, companies should ensure that their ESG product claims align with an overall ESG strategy. A recent study indicates that ESG-related growth can be achieved by brands of all sizes and types, including national or private label, and high or low-priced items. Companies should identify the actions which have the most significant ESG impact and then advertise those actions through their product portfolios.To have more impact on ESG and achieve substantial growth, companies should not make a big bet on just one product or category. Instead, it is better to include high-impact ESG-related benefits across various categories and products.

- To ensure that investments in product design take into account both growth potential and cost, companies can integrate ESG-related claims into their product design process. By building comprehensive product design capabilities, which consider factors such as costs, quality, and ESG-related impact, companies can maximize the impact of their ESG investments. This is particularly crucial during inflationary periods. By using a focused design approach for sustainability, product designers can optimize ESG-related features that are important to consumers in terms of visibility, effectiveness, and cost-efficiency. At the same time, ingredients, materials, and processes that do not contribute to this goal must be removed.

- Consider investing in ESG by including both existing as well as new and innovative products in your portfolio. Achieving a balanced mix of new and established products is usually beneficial for your investment. ESG-related claims can add value to both types of products. According to this study, an established flagship product competing in a crowded market may gain a competitive advantage by incorporating relevant and distinguishing ESG-related claims.It is essential to prioritize environmentally and socially responsible products in a company’s innovation pipeline to meet customer demand and advance the company’s overall Environmental, Social, and Governance (ESG) strategy, as new products play a significant role in boosting category growth.

- To gain insights into ESG-related dynamics, it’s important to study category-specific patterns. Different categories have unique characteristics, so understanding which high-impact ESG claims work best in each one can help companies focus on the most important claims for consumers.Being mindful of how certain ESG claims align with a company’s brand identity or help distinguish it from competitors can also be advantageous for businesses.

- To fully leverage the benefits of ESG, it is recommended to develop products that address multiple ESG concerns as consumers may not consistently respond to specific ESG-related claims in all categories. Instead, consumers tend to prefer products that make multiple ESG-related claims, which can effectively contribute towards a company’s overall ESG goals and earn their authenticity and commitment.Adding additional environmental, social, and governance (ESG)-related benefits to a product can result in the same amount of growth as introducing the first benefit. To achieve even greater growth and provide better ESG-related benefits, companies should evaluate each category and brand individually to decide if and how they can add multifaceted claims.